As a PR professional the simplest industry standard of measuring coverage I have come across has been advertising value equivalent (

AVE), which loosely translates to the amount you would have to spend to buy the same space as the article appeared in a print publication.

It is only recently we have started to wonder what impact an article would have if it is carried in the online edition.

Most Indian publications treat their online editions as an extension of their print counterpart. Many of these media houses had a head start in the online space with the Hindu launching its online edition way back in 1995. But, in terms of innovation and adapting new emerging realities of web 2.0 there is a gross disconnect.

The lacks of interactivity and underleveraged potential of citizen journalism are two broad negatives that stick out like a wart. This may be due to the restrain on the part of media companies to hire new media professionals who understand the new form of reportage due to the supply-demand pressure and unproven economies of scale.

As opinions in the article “Why are print dailies so conservative with their online editions?” on exchange4media.com suggests:

A senior executive of an online firm says, “It’s like a chicken and egg situation. Media companies do not intend to have a separate sales and content team for the online edition, apprehending that the expenses can’t be recovered. Similarly, without a dedicated team, they can’t look at earning sizeable revenue from the online venture.”“It’s also because many print media owners have already burnt their fingers during the dotcom boom, which is why they are extra cautious while implementing any online plan,” says another media observer.So how do the online editions fare vis-à-vis their print avatars. This has been a question in my mind for a long time. Quite frankly I hoped some one could come up with this analysis and save me the trouble!

Method in madnessI compared the traffic statistics of leading English language Financial Dailies in Mumbai - in terms of brand equity and circulation. I picked financial dailies considered as they are considered as the bastion of corporate voice and have a stickiness factor when it comes to reading habits of their core audiences.

Think of a “suit” headed to work with a copy of The Economic Times safely tucked away under his arm.A comparison between their print and online editions should give an insight into their relevance to their target audiences which is mostly a captive demographic which has about 9 -10 hours of internet access at workplace and is often the sole source of news based information.

The English language Financial Dailies I chose are as follows:

The Hindu Business Line,

The Financial Express,

The Economic Times,

Mint and

Business StandardComparison was done using three free web analytics tools

Alexa,

Compete and

Google trends for websites.

Below are the

print circulation figures of these financial dailies as of 2009. The source is a leading PR measurement company based in Mumbai.

The

Alexa Site comparisons are as follows

This is how they fare on

Compete

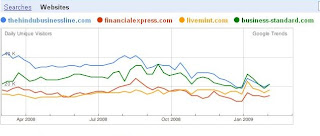

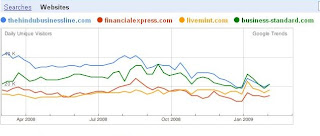

And lastly

Google trends

Google trends and Alexa (free analytics tool) do not map sub-domains (at least to my knowledge) so there may be a noise in the numbers for The Economic Times which is hosted on

http://economictimes.indiatimes.com/ and not

www.indiatimes.com as it is compared on these tools.

Here’s a look on the numbers on Google trends without The Economic Times (Indiatimes) websites:

Findings

Findings1. The most widely read financial publication The Economic Times has a total circulation of 2,30,000+/- in Mumbai while the online edition has the average monthly unique traffic of 1,50,000+/- (compete)

2. The Hindu Business Line with a circulation of 19,000+ in Mumbai is the lowest within current parameters. Its online edition generates average monthly unique traffic of 30,000+/- to 40,000+/-

3. Mint, which has undertaken a lot of social media initiatives on their website including the popular

livemint radio by

Kamla Bhatt, of

the Kamla Show fame, has an almost equivalent circulation and traffic of 50,000+/- in their print and online editions.

In the same context, blogger and social media consultant

Kiruba Shankar is involved with the

podcast show with Business Standard, who opines

"Less than 1 per cent of the total news content generated on the newspaper websites is powered by citizen journalists." [See Exchage4media article below]

Conclusion1. Print publications in India clearly are at par and even doing a lot better in terms of audiences as compared to their online editions.

2. The clear advantage of online medium such as interactivity, dynamic multimedia content, search engine optimization, user generated content etc. are grossly underleveraged and may be the reason for the for their inability to drive proportionate traffic

3. The stickiness of print publications amongst people interested in financial news is high, which also indicates a slight preference in the favour of newspaper over online editions

4. Also,

The Long Tail of online financial media in India may be a reason for this fragmented audience overlay. The leaders w.r.t access to corporate news

Moneycontrol.com,

Capitalmarket.com,

India Infoline,

Rediff Business,

BSE India, etc. are popular and enjoy a loyal user base as they provide interactive content which an end user can access as per his discretion and requirements – in packets on media bytes & sections - at a time when he pleases to.

What does this mean?While it is a forgone conclusion that print publications need to pay attention to their web properties and make them profitable by adopting web 2.0 technologies and evangelizing them down to the reporters on field.

Online media, no doubt needs to figure in the media plan of PR professionals in the financial sector, a mix of both print and online would be the ideal in achieving the desired mindshare.

Notes

You may visit the following links for further details:

Why print dailies are so conservative in their online editions[Exchange4Media] [March 12 2009]

Growth for Newspapers Online? Yes and No.[Brian Solis PR2.0]

[Jan 28 2009]

Word of advise These figures are from reliable industry sources and free web analytics tools. So there may be a little noise while reporting the figures and must be understood in this context. Nonetheless, these trends, act as guidelines to the broader picture.

News feeds subscription to the online editions have not been factored which again may cloud the figures as some people may choose to read their news in feed readers rather than visit the website.

Collaborative efforts to refine the findings of this analysis are most welcome. Write to me at hemantmorajkar [at] gmail[dot] com or tweet me

@HemantM